Business Models

On the link you will find a PDF-file with different versions for analysing, planning or designing a business model. There is also a German PDF-file.

What is a Business Model?

A business model represents how a company intends to create value. At the center of a business model is the product or the set of products that produce customer benefit. A business model requires from a company to describe its approach to revenue generation. Revenue is a function of the product price and the amount of customers buying the products. The company further needs to specify on which markets its wants to operate and to define how it plans to market its products, i.e. how to reach the customers and inform them about the products by help of marketing or branding. In the business model, the company also defines the channels for selling the products or set of products.

The business model further requires from a company to formulate its approach to managing the costs incurred for operations and production, delivery, logistics and distribution, branding and marketing, sales and administration, as well as funding.

The purpose of any company is to continuously create valuable products that have customer benefit (the WHAT) from organizing the utilization of resources (the HOW). In order to achieve this the company management needs to decide which resources are necessary internally or externally, and how to structurally and systemically organize all of these in order to reach the company objectives. Also company management needs to define how it positions itself in the context of the environment, society, or governance.

What is a Business Model Concept?

At their core, business model concepts address one fundamental question: How does a particular company function as a value-creating system?

The purpose of a business model concept is not to describe a company in detail, but to make the logic of how its business creates, delivers, and captures value explicit, discussable, and designable.

Creating a Shared Understanding

Business model concepts provide a common language across functions such as strategy, marketing, operations, finance, and innovation. They enable stakeholders with different perspectives to discuss the same organization using a shared structure, reducing misunderstandings and siloed thinking.

Making Value Logic Visible

These frameworks reveal the cause–effect relationships within a business by showing how:

- internal capabilities and governance enable offerings,

- offerings are delivered to markets and customers,

- revenues and financial outcomes are generated,

- external actors and constraints influence performance.

This visibility is critical because many assumptions about “how the business works” otherwise remain implicit.

Supporting Analysis and Diagnosis

Business model concepts help identify:

- strengths and weaknesses,

- inconsistencies between value creation and value capture,

- hidden cost drivers,

- dependency risks (e.g. suppliers, partners, capital),

- misalignment between market needs and internal capabilities.

They provide a structured way to ask the right questions.

Enabling Design and Innovation

Beyond analysis, business model frameworks are design tools. They allow organizations to:

- modify individual components intentionally,

- explore alternative revenue or pricing logics,

- test new market or delivery models,

- reconfigure partnerships or cost structures.

This supports business model innovation, not just product or process innovation.

Integrating Strategy and Operations

Unlike pure strategy tools, business model concepts connect strategic intent with operational reality. They show how vision, positioning, and competitive advantage must be supported by:

- resources and processes,

- organizational structures and governance,

- financial and cost logic.

Structuring Complexity

The purpose of these frameworks is not oversimplification, but complexity reduction through structure. They highlight what matters most for decision-making while keeping the overall system understandable.

Supporting Communication and Alignment

Business model concepts are particularly effective for:

- leadership and management discussions,

- cross-functional workshops,

- investor and stakeholder communication,

- teaching and learning contexts.

They foster alignment by making assumptions visible and discussable.

Alternative Business Model Concepts

Business Model Canvas

Notably, the most well known and most widely applied business model concept is the Business Model Canvas (BMC)

The canvas is structured around nine interconnected building blocks that together explain how a business operates. These blocks cover the customer side of the business, the internal infrastructure required to deliver value, and the financial logic that sustains the organization.

At the center of the canvas is the value proposition, which explains what products or services are offered and why customers find them valuable. This value proposition is linked to customer segments, which define the groups of customers the organization aims to serve, and to channels and customer relationships, which describe how the value is communicated, delivered, and maintained over time.

On the operational side, the canvas includes key resources, key activities, and key partnerships. Together, these elements describe the assets, actions, and external collaborations required to create and deliver the value proposition efficiently.

The financial dimension of the Business Model Canvas is represented by revenue streams and the cost structure. These elements explain how the organization generates income from customers and what costs are incurred in operating the business model.

The Business Model Canvas is designed as a lean, pragmatic, and highly accessible tool. Its primary strength lies in simplicity. By organizing a business model into nine tightly defined building blocks on a single page, it enables fast understanding, discussion, and iteration. The BMC places strong emphasis on the customer-facing logic of a business: value propositions, customer segments, channels, relationships, and revenue streams. Internal aspects such as resources, activities, and partners are included, but mainly to support the customer and revenue logic. As a result, the BMC is especially well suited for start-ups, innovation projects, early-stage ventures, and workshops, where speed, simplification, and experimentation are valued higher than completeness.

The Business Model Components Map

The

Business Model Components Map (BMCM)

, by contrast, is a more comprehensive and systemic framework. It explicitly structures the business model along the logic of value origination, value proposition & delivery, value generation, and value contribution. This allows the BMCM to integrate elements that are only implicitly or partially addressed in the canvas, such as governance, ownership, capital structure, organization, assets, ESG considerations, competition, liquidity, and cost management as a foundational design element. The BMCM is therefore not limited to explaining how a business earns money, but also how it is embedded in its institutional, societal, and competitive context.Another key difference lies in how both frameworks treat value creation versus value capture. The BMC strongly links value creation to customer value and revenue streams, which works well for market-driven innovation. The BMCM separates these logics more clearly by distinguishing value origination from value generation, making it easier to analyze established organizations, complex business systems, and long-term sustainability. In this sense, the BMCM supports deeper diagnosis, alignment, and governance-oriented analysis.

The BMCM excels as a strategic, analytical, and educational framework, especially for established firms, consultants, academic contexts, and situations where ownership, regulation, competition, and societal impact matter explicitly.

The

Business Model Components Map (BMCM)

and theBusiness Model Canvas (BMC)

are both conceptual frameworks used to describe how a business creates, delivers, and captures value. They share this fundamental purpose, but they differ significantly in scope, depth, and intended use.In summary, the Business Model Canvas and the Business Model Components Map are not competing tools, but complementary perspectives. The BMC offers speed, focus, and simplicity, while the BMCM offers breadth, depth, and systemic integration. The choice between them depends on whether the primary goal is rapid business model design or comprehensive understanding and strategic alignment.

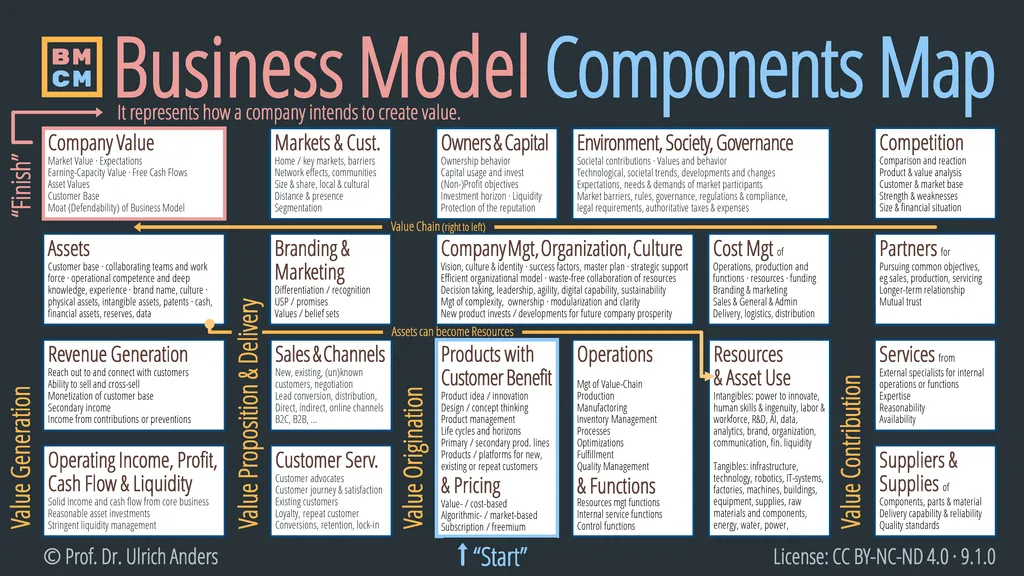

The Business Model Components Map

The Business Model Components Map (BMCM) has been designed as a map that displays the most relevant components of a business model in an orderly manner. All components are grouped in four areas:

-

Value Origination:

Value origination represents the starting point of the business model and explains how value is created at its source inside the organization. It captures the internal logic, governance, and conditions that enable a company to develop offerings and prepare them for the market.-

Products with Customer Benefit & Pricing is the central origination component because it defines what the company brings into existence as an offering and why it matters. Here, value originates through product ideas, innovation, concept development, and product management across lifecycles. Pricing sits directly inside this component because the moment the company sets a pricing logic—whether value-based, cost-based, market-based, algorithmic, subscription, or freemium—it is already shaping how value can later be captured and sustained.

-

Operations & Functions describe how product ideas are turned into reliable and scalable outputs. This component ensures that the value chain functions smoothly, from production and manufacturing to inventory management and fulfillment. Operational processes, quality management, and optimization activities make value creation efficient and repeatable. Supporting and control functions ensure coordination, compliance, and stability across the organization, enabling products and services to be delivered consistently.

-

Resources & Asset Use explain the foundation on which value origination rests. Assets such as infrastructure, technology, data, human skills, intellectual property, and financial resources only create value when they are actively deployed. This component shows how tangible and intangible assets are mobilized to support innovation, production, and organizational performance. Effective use of resources determines productivity, adaptability, and the company’s ability to scale or innovate.

-

Company Management, Organization, & Culture integrate all elements of value origination. Leadership, vision, organizational design, decision-making structures, and cultural norms determine how effectively resources, operations, and governance requirements are aligned. This component ensures coherence, adaptability, and long-term orientation.

-

Cost Management supplements Company Management by controlling the economic foundation of value creation. It ensures that products, operations, and organizational structures are designed within sustainable cost boundaries. Cost transparency and efficiency protect the viability of the business model from the outset.

-

Environment, Society, & Governance belong to value origination because they define the framework conditions under which value creation is legitimate and possible. Regulatory requirements, societal expectations, ethical standards, sustainability considerations, and governance structures influence how products are designed, how operations are organized, and which strategic options are feasible.

-

Owners & Capital shape value origination by defining financial constraints, objectives, and strategic priorities. Ownership structure, capital availability, investment horizons, risk tolerance, and return expectations influence which products are developed, how aggressively the company grows, and how resources are allocated.

-

-

Value Proposition & Delivery:

Value proposition and delivery focus on how internally created value is shaped into a compelling offer and brought to customers in a way that builds trust and long-term relationships.-

Markets & Customers define where and for whom value is created. This component explains market selection, segmentation, customer needs, purchasing behavior, and geographic or cultural context. It anchors the business model in real demand and ensures that value creation is market-relevant.

-

Branding & Marketing connect the company’s internal capabilities to external perception. This component explains how the company positions itself, differentiates its offerings, and communicates meaning to the market. Branding expresses values, promises, and identity, while marketing ensures visibility and recognition. Together, they shape expectations and influence how customers interpret the value proposition.

-

Sales & Channels describe how the value proposition physically and digitally reaches customers. This component explains how customers are acquired, how relationships are initiated, and how transactions take place. Different channels and sales approaches determine market reach, accessibility, and customer convenience. Sales and channels translate interest into actual demand and ensure that value is delivered at the right place, time, and format.

-

Customer Service represents the relational side of value delivery. It explains how the company supports customers before, during, and after the purchase. By managing the customer journey and ensuring satisfaction, this component turns one-time transactions into ongoing relationships. Customer service strengthens loyalty, retention, and advocacy, extending value delivery beyond the initial sale.

-

-

Value Generation:

Value generation explains how delivered customer value is converted into financial outcomes and lasting economic strength.-

Revenue Generation describes how the company monetizes customer relationships. It explains how sales, recurring income models, cross-selling, and secondary revenue streams transform delivered value into income.

-

Operating Income, Profit, Cash Flow, & Liquidity express the financial sustainability of value generation. This component shows whether the business model produces sufficient earnings, maintains healthy cash flows, and ensures liquidity to survive volatility and finance future development.

-

Assets capture the accumulated results of value generation over time. These include physical, financial, and intangible assets such as infrastructure, intellectual property, data, brand strength, customer base, and organizational know-how. Assets reflect what the company has built and preserved through successful value creation.

-

Company Value represents the overarching result of the business model. It reflects market expectations, perceived future potential, and strategic positioning. Company value is influenced by earnings capacity, asset quality, customer relationships, and the defensibility of the model.

-

-

Value Contribution:

Value contribution captures the external ecosystem elements that enable, constrain, and amplify the business model. It reflects how value is co-created beyond the boundaries of the firm.

-

Suppliers & Supplies contribute essential inputs to the business model. Their reliability, quality, and delivery capability directly affect operational stability and the company’s ability to fulfill its value proposition.

-

Services from External Specialists complement internal capabilities by providing expertise, flexibility, and scalability. They allow the company to access specialized knowledge and capacity without internalizing all functions.

-

Partners extend the business model through collaboration. Strategic partnerships support shared objectives in development, production, distribution, or service and enable access to markets, capabilities, or resources that would otherwise be difficult to achieve.

-

Competition represents the external pressure that continuously tests the effectiveness of the business model. Competitive dynamics influence pricing power, differentiation, customer choice, and strategic positioning, shaping how value must be defended and renewed over time.

Each component itself has many elements that often need to be considered in the components. The components help to break down the business model into 19 parts. They are all connected, but can otherwise be analysed or viewed separately in order to reduce complexity.

One can use the Business Model Components Map to analyse a business model of a company, to benchmark one business model against another, to develop a business model for a startup, to further enhance an existing business model, or as a checklist to start the discussion of some relevant points within each element of a business model.

In addition, one can also use the Business Model Components Map to locate certain projects, for carrying out project work, for understanding, which components or elements of a business model need to be improved, or for building an M&A-case that results from generating synergies in one or more components.

What is a Working Business Model?

A Business Model is working if it eventually creates value and this value creation allows the business model to become self-sustained. The company that employs the business model is not burning equity and doomed to fail.

In contrast, a business model does not work if it does not create value. Either it does not generate significant revenue, it fails to attract a significant number of customers, or it does not succeed to monetize customer relationships in an overall satisfactory manner.

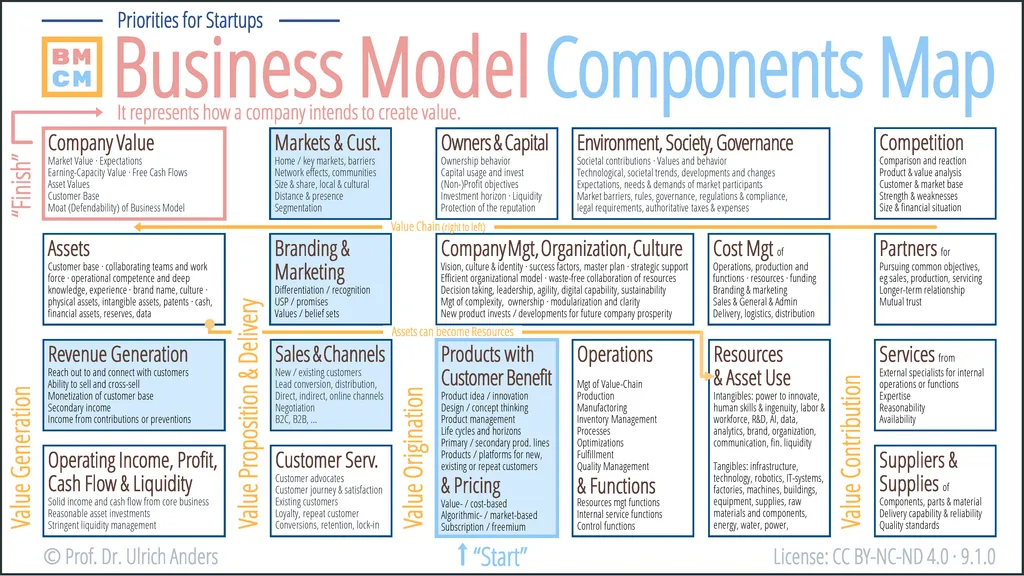

Business Models for Startups

To formulate and achieve a fully blown Business Model is a complex, cumbersome, and time consuming tasks. For that reason, it is important for a Startup to focus on the most relevant components of a business model, which are the components that are in direct connection with the customer (displayed with light blue background in the picture). This is first of all the core product that must generate customer benefit.

The further essential components for startups are the definition of the customer segments and the markets in which to target these customer segments, the branding and marketing approach to reach the customers and for revenue generation the channels to be used.

What are Digital Business Models?

The term Digital Business Models can mean several things:

-

Already existing business models, in which functions, processes, resources, assets, market access, etc. are enhanced or supplemented by digital technologies (e.g. automation, AI, robotics, [big] data collection and analysis). This is also commonly referred to as digital transformation of business models.

-

Business models in which companies offer services around or with digital solutions. The advantage of these business models result from economies of scope and is typically B2B. The expertise of the company is applied to many client companies. Since the products are digital the company must not be physically present at the client companies. If this is the case, travel expenses fall away and the services can be offered internationally. However, because the services are typically customer individual such business models are more difficult to scale because more customers generally require more employees.

-

Business models in which companies offer high quality open source, free or rather cheap solutions in order to attract a large customer base. Customers from the customer base can then receive group or individual services, coaching, consulting typically in conjunction with the free content.

-

Business models in which companies offer digital products. The advantage of these business models result from economies of scale. A principally identical digital product can be sold to many customers. Such business models are typically B2C.

-

Business models in which companies do not offer products themselves. Instead they offer platforms on which products can be traded, bought or sold. The platforms offer their customer an efficient access to a large market. In times of tight global markets the value of an increasing amount of companies results less from its ability to produce but more from its ability to sell. Therefore the advantage of these business models results from having a strong customer connect. Such business models can be both B2B and B2C.

What are New or Innovative Business Models?

According to the definition, the logic with which a company strives to create value is represented by its business model. The components of a business model are always the same. A new or innovative business model, therefore, is when companies do at least one innovation in any of the components of the business model and if this eventually leads to the generation of value, to more revenue, or to less costs.

One example: classically, revenue is generated by selling products or services. In newer, but by all means not new any more, business models companies offer the product or service for free. The revenue is then created by help of monetizing the customer connection, e.g. through advertising or through the sale of insights from customer data.

The huge values of a now significant number of companies no longer stem from the value of their substance or from their ability to generate profits and cash flows, but from their large number of customer connections which are assumed to be monetized at some point in time in the future.