SQUID, don’t SWOT

The SWOT framework (Strength, Weaknesses, Opportunities, Threats) is often used by analysts and management consultants to portray companies. The SWOT framework is divided into two parts:

-

the internal company analysis based on know-how and core competencies identifies strengths and weaknesses and

-

the analysis of the external environment in the form of competitors, customers, suppliers, regulatory and societal aspects leads to a display of opportunities and threats.

As good and proven as the SWOT framework is, it has several disadvantages. First of all, the SWOT analysis is a static description of the state of the company and, therefore, more related to a point in time — it would be better to consider a period of time.

It only offers elements for a status-quo analysis. It does not offer analysis elements for what would be sensible to do. Second, the SWOT framework often leads to some redundancy. Weaknesses turn into threats, strengths turn into opportunities. Reducing weaknesses also leads to opportunities. Third, the SWOT framework is not activity oriented. To my mind, SWOT is too static and does not fit any longer into times that require analyses to be actionable. This means analyses should result in suggestions for activities.

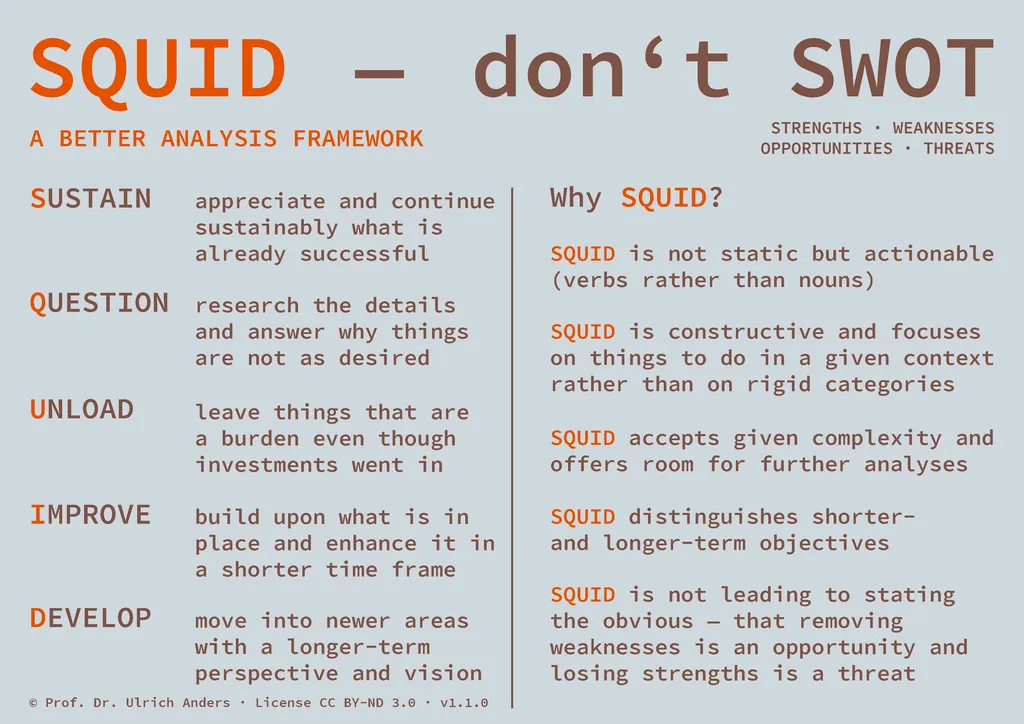

For that reason, I have developed an alternative analysis framework: SQUID (Sustain, Question, Unload, Improve, Develop).

SQUID has several advantages over SWOT in terms of company analysis. First of all, SQUID is geared towards activities and time. SQUID always starts from the current situation. What should you do to move a company forward? What should be kept? What should be questioned? What should one leave? What should be improved (in the short term)? What should be developed (in the long term)?

With these questions you look at the company all round and take into account not only the internal competencies, but also the external context. In addition, SQUID also offers space for time prioritization and takes feasibility into account. Some desirable opportunities cannot be reached quickly, but have to be developed over a certain period of time.

SQUID has proven itself for both strategic and financial analysis of companies (e.g. in an M&A context). An example: Unload can on the one hand refer to an older product, but on the other hand it can also refer to a financial participation. On the one hand, SQUID is simple and intuitive enough to be used quickly, clearly and without extensive explanations. On the other hand, SQUID also allows an all-round analysis of a company with regard to the essential questions and categories.